Hi, Uk tax payer here

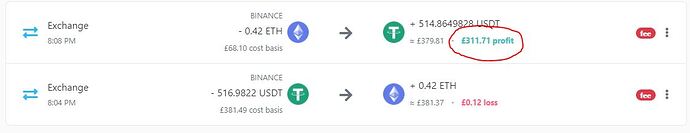

I made a test ETH trade today, where I bought 0.42 ETH and then hit a stop minutes later which sold the 0.42 ETH. My crystallised loss was about ~$2.

What is confusing me a bit is this:

I understand that the shared cost pooling is at work here and considers my sale to be liable for gains because it doesn’t match it with the buy transaction earlier to work out that the trade was a loss.

So in real terms, what does this gain mean for my taxes ? Do I have to pay gains for a losing trade because my overall cost basis was fairly low ?

I was under the impression that buys and sells of the same asset class on the same day were put into a separate pool.

I’m fairly new to all this so any help is much appreciated !