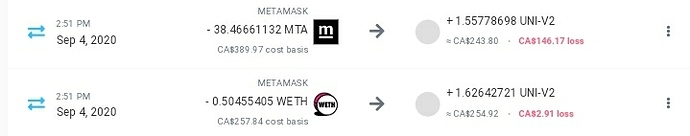

Added support for liquidity pools: Uniswap, Balancer, Sushiswap, Mooniswap, Curve, Bancor, YFI, Crypto.com Defi, Cream, Value Defi

If you would like to see support for a pool that we don’t already support then just create a feature request. Liquidity pools that give you a token back are treated the same way as regular crypto to crypto trades.

IMPORTANT This update is not retroactive so if you already added your ETH wallets, you will need to delete and re-add them!

Added support for staking/mining pools

If you are sending your coins to a CDP, staking/mining pool or simply lending them or using them as collateral then you can mark these withdrawals as “Sent to Pool” which will avoid realizing gains and keep track of them as if they are still owned by you.

If you are receiving coins back from a pool then simply mark the transaction as “Received from Pool” which will basically move the funds back into your wallet.