Koinly support has said that the IRS has no problem with aggregating transactions on the 8949, however the 8949 instructions are very clear in that you can only aggregate transactions when cost basis is reported to the IRS (which it isnt for most crypto transactions)

Can someone from support please provide us with a source on the IRS accepting aggregated crypto transactions or provide a way to generate a report that satisfies Exception 2 below? Thank you.

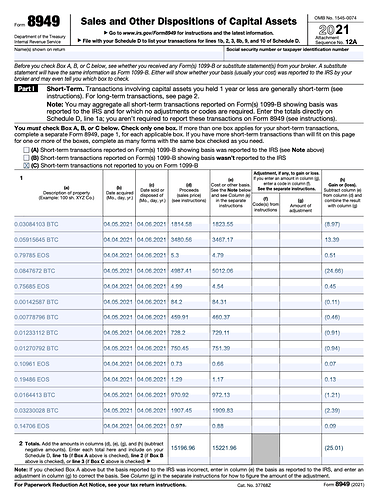

Exceptions to reporting each transaction on a separate row.

There are exceptions to the rule that you must report each of your transactions on a separate row of Part I or II.

Exception 1.

Form 8949 isn’t required for certain transactions. You may be able to aggregate those transactions and report them directly on either line 1a (for short-term transactions) or line 8a (for long-term transactions) of Schedule D. This option applies only to transactions (other than sales of collectibles) for which:

- You received a Form 1099-B (or substitute statement) that shows basis was reported to the IRS and doesn’t show any adjustments in box 1f or 1g;

- The Ordinary box in box 2 isn’t checked;

- You don’t need to make any adjustments to the basis or type of gain (or loss) reported on Form 1099-B (or substitute statement), or to your gain (or loss); and

- You aren’t electing to defer income due to an investment in a QOF and aren’t terminating deferral from an investment in a QOF.

Exception 2.

Instead of reporting each of your transactions on a separate row of Part I or II, you can report them on an attached statement containing all the same information as Parts I and II and in a similar format (that is, description of property, dates of acquisition and disposition, proceeds, basis, adjustment and code(s), and gain (or loss). Use as many attached statements as you need. Enter the combined totals from all your attached statements on Parts I and II with the appropriate box checked.

For example, report on Part I with box B checked all short-term gains and losses from transactions your broker reported to you on a statement showing basis wasn’t reported to the IRS. Enter the name of the broker followed by the words “see attached statement” in column (a). Leave columns (b) and (c) blank. Enter “M” in column (f). If other codes also apply, enter all of them in column (f). Enter the totals that apply in columns (d), (e), (g), and (h). If you have statements from more than one broker, report the totals from each broker on a separate row.

Don’t enter “Available upon request” and summary totals in lieu of reporting the details of each transaction on Part I or II or attached statements.