2 Questions

I have transactions going back to 2018 that I am finally declaring because I finally made a major withdrawal. Which plan should I get?

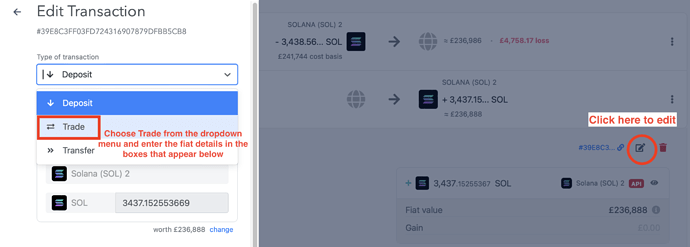

My initial deposits were from Quadriga. All that is seen now are Eth deposits. How do I manually make them fiat to crypto exchange transactions?