Hi everyone,

I have read the following article:

https://help.koinly.io/en/articles/3664156-how-to-add-transactions-manually

I did not understand how the 2 methods to represent a transaction of purchasing crypto using fiat that is mentioned in the “For trades/buys/sale” part of the article will result in the exact tax report?

When I’m using Binance API to automatically pull the data it shows me a trade and tags it as a ‘Buy’

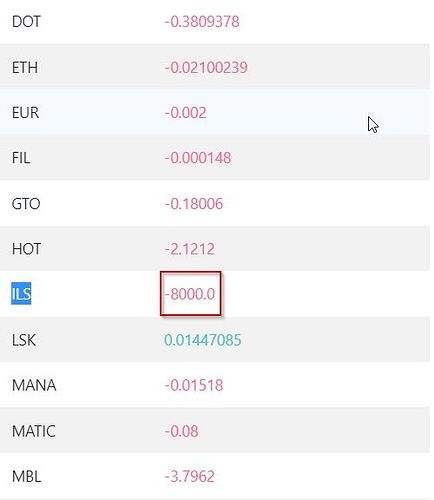

and then when I’m reviewing the wallet it looks like the fiat amount is missing (Figure 2)

- When I’m clicking on the ‘Tax Reports’ tab and then checking if there are issues with the wallet, then it does not show the problem with the missing 8000 ILS

So my question is what a transaction of purchasing crypto using fiat should look like? Should I delete the ‘Buy’ trades that are being pulled automatically from Binance API and then manually create a ‘Deposit’ transaction and set the fiat worth of the transaction?

Thanks.