Edit: It’s not so clear but this reply is only referring to the CRV + ADA issues.

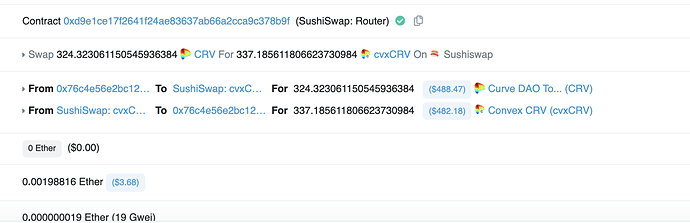

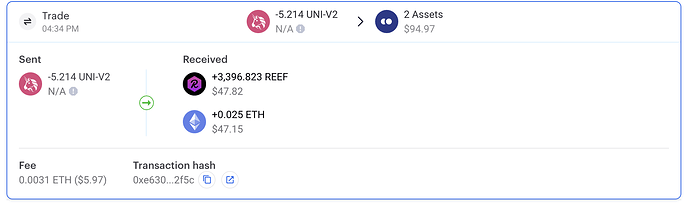

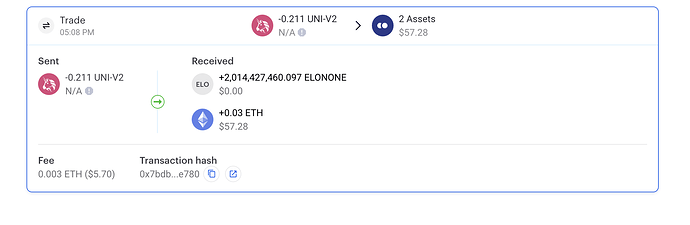

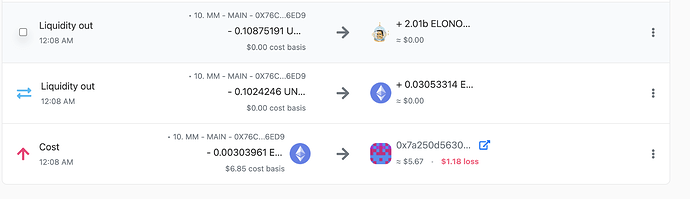

This transaction is only a trade, there is no deposit/transfer according to etherscan.

Is it possible that the deposit that you mention is actually listed as a separate transaction (with a separate TxHash)?

I believe that is probably the case.

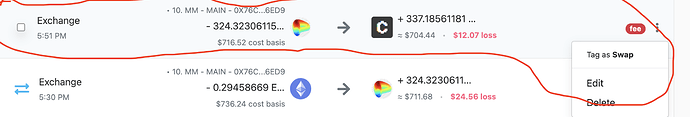

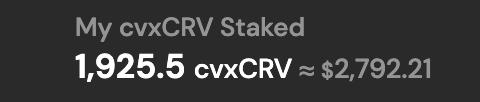

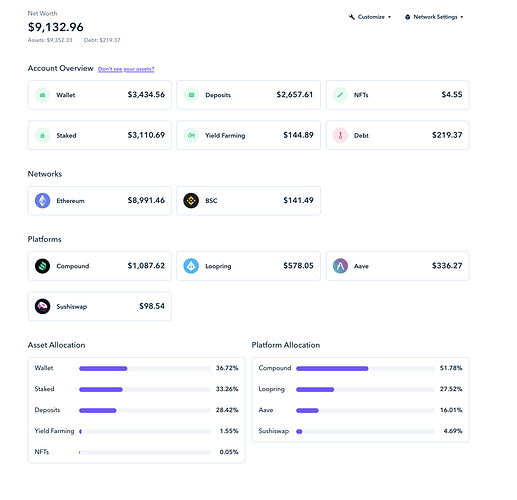

The CRV to cvxCRV is then treated correctly but can be tagged as a Swap if you believe that this does not constitute a taxable event.

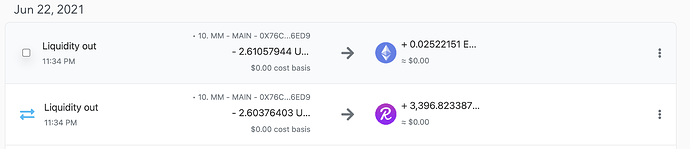

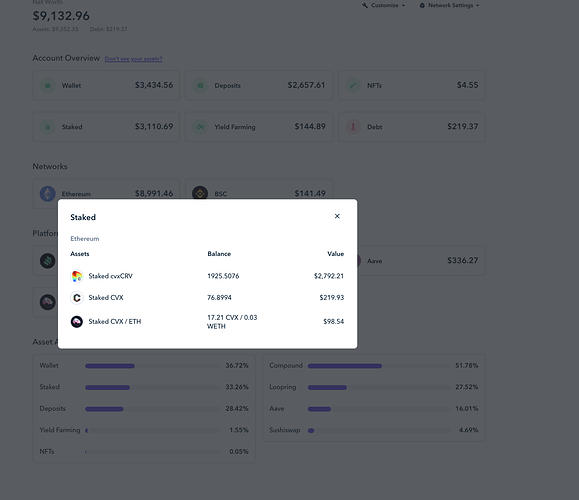

The Withdrawal of cvxCRV can then be tagged as a ‘Sent to pool’ which tells Koinly that these are still your tokens, even though they are leaving your wallet. If you tag these withdrawals appropriately, you will see the tokens and their values listed on your dashboard.

Your Cardano issue is also a common one. I would recommend exporting the complete transaction history from your Yoroi wallet as that currently works better than the API if you have multiple addresses. We will be looking for better ways to sync Cardano but it’s not so simple since their system is totally unique (compared to BTC, LTC etc. that all use the same system).

//Petur