Hi

I recently signed up with Koinly, ran a few reports and showed it to my accountant. My accountant followed up with the following remarks:

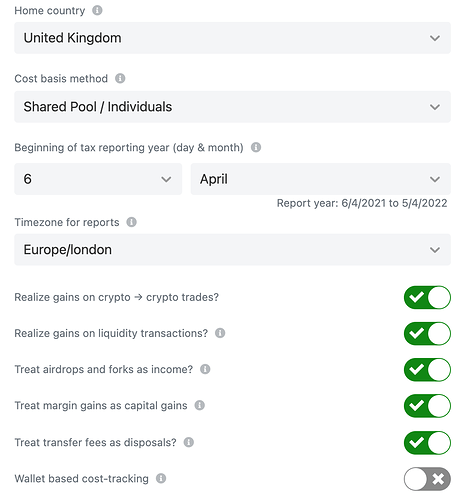

Blockquote" I can see the Koinly is not calculating the gains as per the UK rules. Koinly is only calculating the gain based on an average method, this is wrong and is not compliant with the UK tax rules."

Can you please advise how you are going to resolve this concern?

Regards

EffKay