If I understand the taxable nature of MEMO/sOHM its being rewarded on a multiple per day period (rebase every 8 hours) and each round qualifies as income. Tracking this information isn’t available for avax as the block explorer does not show when these rebases happen (3 per day) against your account. So for avax users its not possible to track at this time unless you can sift through millions of records against the contract address. The reward can be averaged over a period knowing the start/end, market price and etc but to your point its “crazy”.

On avax, wMEMO was created as a wrapper to stop taxable events from happening as the new token is just increases in value & not shares. I recommend anyone entering MEMO to immediately exchange it for wMEMO. @Paul_Russell I would recommend looking into if sOHM has a wrapper equivalent.

@koinly

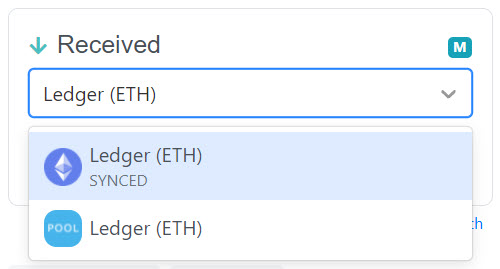

I am having a similar problem tracking TIME/MEMO & wMEMO on the AVAX network, please hurry on AVAX support. For me, Koinly is not showing any withdraws so I cannot mark the transaction as `Sent to Pool`. Each time I exchange TIME for MEMO I have two MEMO deposits. Manually converting to an exchange leaves 1 deposit hanging which I have to manually delete. When the transaction is listed as Deposit it only gives an option to mark as `Received from Pool`.

Furthermore, the UI has no understanding of the the two tokens in my case (MEMO, wMEMO) as well as others in the Abracadabra ecosystem. It should at least allow me to manually enter a contract address to use for manual ticker symbols at least if not automated valuations on top of that.

Memo is a 1:1 stake swap against Time Wonderland while wMEMO is a wrapper around MEMO designed to stop taxable events and enable borrowing value against collateralized positions using Magic Internet Money.

Contract Addresses:

- Staked Spell: sSpell - 0x3Ee97d514BBef95a2f110e6B9b73824719030f7a

- Wrapped Memo: 0x0da67235dD5787D67955420C84ca1cEcd4E5Bb3b

- MEMOries: 0x136Acd46C134E8269052c62A67042D6bDeDde3C9

If anyone has a solution to this please let me know. I have been trying to find a different ticker with no market data to manually insert a value into and subsequently remember it forever.