I purchased Trader Plan, i can check my Net gains, Loss and Profit.

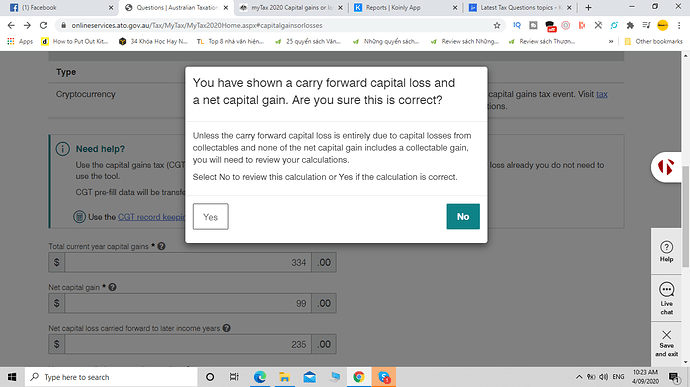

Then, i filled it in the blank already. However, this warning appeared. It seems that they want me to show the crypto report to clarify things.

How can i show my crypto report to the ATO?

The fields from the Complete Tax Report should be entered like this:

Total current year capital gains = Profits, before losses

Net capital gains = Net gains (only if net gains is more than zero otherwise set this to 0)

Net capital loss carried forward: Net gains (only if net gains was less than zero)

In your case since you made a net profit, the loss field should be left blank or zero.

Source: https://www.ato.gov.au/Individuals/myTax/2020/In-detail/Capital-gains/

I really appreciate your support, thank you very much.

Now i am more convenient to go deeper into Crypto world.

I just have one more question. So whenever i do the crypto tax report in one financial year, i just need to finish these 3 fields, is it right?

How the ATO staff check whether i report my crypto transactions true or not? If they want more clarified information from me. So i just give them the Koinly full tax report (PDF file that i purchased from Koinly). Am i right?

Yes, if they ask for your calculations then you can give them either the Complete Tax Report of the Capital Gains csv.

Hi,

I have purchased plan for the financial year of 2019 - 2020 for Australia. My data has been imported from Coinspot wallet through key. The problem is that the fee is calcaluted as a gain in the tax report which incorrect and I have sent btc to other wallets, they have been calculated as disposal. How are they treated and calculated?.

Thanks

Ali