Thanks for the additional info Levi.

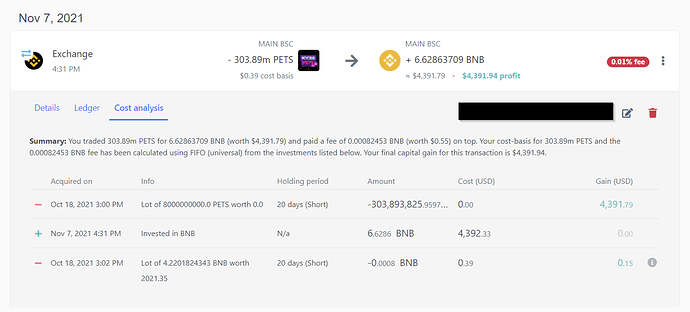

For Q #1, you need to look at the transactions where you are acquiring the PETS to set the cost base that you believe is appropriate for tax purposes. I am guessing you are applying US tax regulations such that the cost base of your PETS should be market value on the acquisition date.

It seems that Koinly is setting the value or worth of the acquired PETS at $0 perhaps because it is seeing the acquisitions as free airdrops/gifts or because it can’t find a market price for the PETS on the acquisition date (in which case Koinly would note this in RED below the transaction). As there seems to be a market price available for PETS, I don’t know why Koinly is valuing the acquired PETS at $0. It could be the tag that Koinly is applying or it could be your settings.

If you want to set the cost base of all your PETS purchases at market value on acquisition date, there may be a couple of different ways of doing this. I would need to see the details of a sample purchase to suggest the easiest way to do this. If you have lots of these transactions, I don’t think you want to set the value manually on each purchase as I suggested in my first reply.

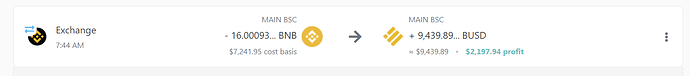

For Q #2, it is difficult to comment without seeing the detailed cost analysis and looking at the history of your acquisitions of BNB vs USD. The only thing I can suggest is that you look at how Koinly assigned the cost base to the 16 BNB that you traded for BUSD. As Koinly is showing a 30% profit on this trade I can only surmise that the market price of BNB has risen significantly against USD between the date you acquired the 16 BNB and the date you traded it for BUSD. Sorry I can’t be more helpful.