In the Koinly instruction video how to do HMRC ( The Complete UK Crypto Tax Guide With Koinly - 2022 - YouTube)

the guy I think has made a boo boo

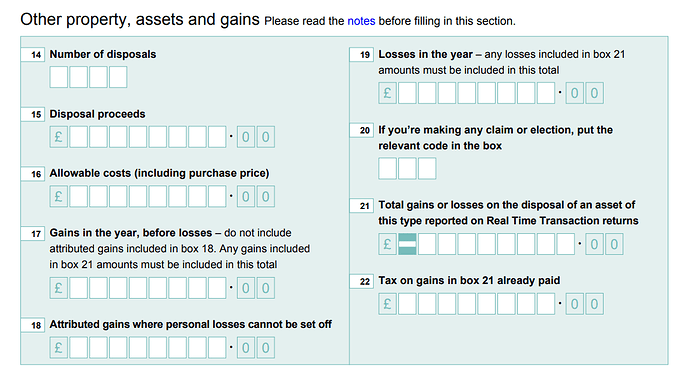

For the box “gains in the year before losses” Koinly calculates Disposable proceeds minus Allowable costs to get the figure. This, however, is the figure for net gains, not gains before losses as the box requires.

so which is right?

as the HMRC report also gives a different number than what is suggested in the video, where he makes “Gains in the year beofre loses as “Disposal proceeds” MINUS " Allowable costs” to get “Gains in the year excluding losses” is this correct?

Coz either the video is wrong or the HMRC report from Koinly is wrong, so which is it?

I just wanna know what to put in box 26 of the self assessment

Also he subtracts ‘lost crypto’ as a loss, and I’m pretty sure you cant do that in the UK