I have a question and I need some advice regarding the Tax treatment for the Celsius Network situation.

As you know, Celsius emerged from Chapter 11 at the beginning of 2024 and they started to return to the creditors part of the cripto locked in their platform. They are returning the funds in the form of BTC and ETH despite the different coins I have in the account of the platform.

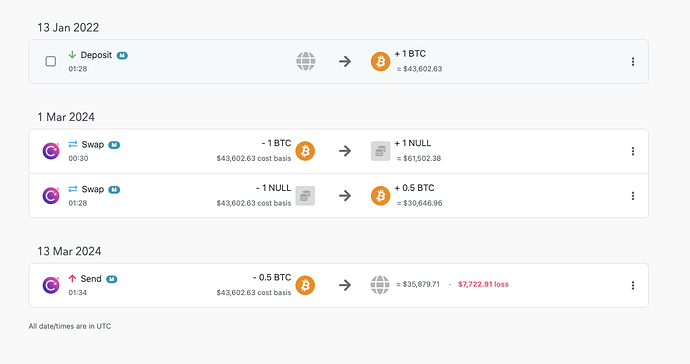

For my crypto tax calculation, I am using for many years already the KOINLY platform connected via API to all my wallets/exchanges.

In those years, I kept the coins balance aligned with the celsius account (via API) and I never declared any losses, because I was waiting to understand the end of this long story.

Now that I start to receive some funds back, as you can imagine I have multiple question regarding tax treatment:

1)- How do I treat the deposit of BTC and ETH in my wallets if I never had BTC and ETH in my Celsius account ? Those are deposits which are not income because it is a refund of part of the coins which I transferred originally in the Celsius platform

2)- Once I have received the crypto distribution from Celsius, how do I align in KOINLY the balance of the coins I still have in Celsius which I know, I will never get back.

3)- Is there any opportunity for the delta amount to declare it as loss ?

The points for me to understand are not only the tax treatment of my refunds but also how to align the balance of each coin to zero without generating any capital gains and possibly to declare the real loss.

Let me know if you can provide me with any advice and/or any documentation which can address those questions.