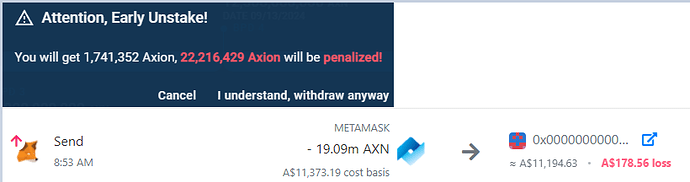

I staked Axion tokens, which is penalised if withdrawn early. The tokens were burnt last year (about 24million), and I can only withdraw 5% of the tokens of which 95% of them become lost forever. Will I be able to realise this tax loss/will Koinly be able to detect I made about 95% loss, given that I lost most of my Axions forever if I do an early Unstake?! As you can see my cost basis was 11K and it was sent to a burn address, but the tokens are only worth 500 now, and if I unstake and sell itll be worth even less, but I can offset my other gains with this tax loss but I want to ensure Koinly will be able to detect it before I pull the trigger.

I see a button, “Sent to Pool” would i mark that transaction as “Sent to Pool” and than the 1.7million axion i get back as “recieved from pool”?? would it know i lost 95% of the tokens though by doing this, or assume I gained 1.7million tokens on top of the existing pool?