hi,

looking at the link below under section 6A.3.1 (also supplied below the link) it seems that koinly isnt correctly calculating offset of losses that are incurred when selling asset within 28 days of acquirring the same asset class and then within 28 days of the sale re buying the same asset class - From document from Revenue.ie below it seems the loss can only be offset when the specific assets acquired within the 28 days are disposed of - koinly seems to just offset the loss when any disposal of that asset class occurs after acquisition

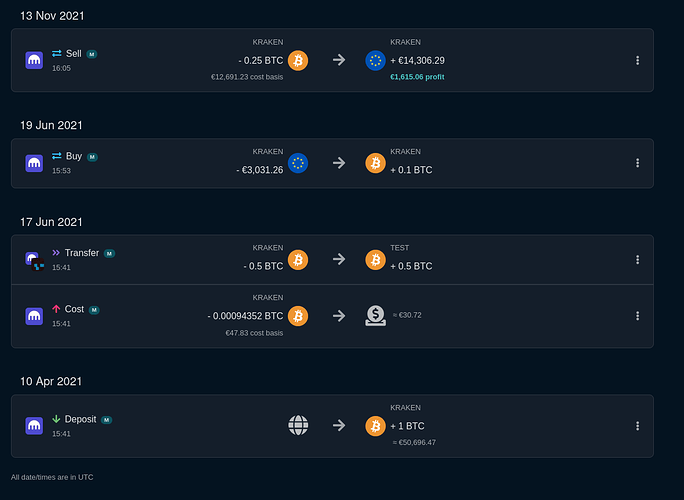

take for example

10/04/21 buy 1.0 btc for 50696.47

17/06/21 withdraw 0.5 btc - incurring a fee in btc of 0.00094352 ( 30.72 in fiat ) - the cost basis of this is 47.83 - making a loss of 17.11

19/06/21 buy .1 btc for 3031.26 - this buy occurs within 28 days of the fee above which correctly removes the loss of 17.11 and using the information below that loss should be associated with the btc bought on 19/06/21 and the loss can only be offset if a gain is made on disposal of these.

13/11/21 sell .25 btc for 14306.29 - this is where it seems to be incorrect - the cost basis for this sell is based on the buy on 10/04/21 (using FIFO)

it shows cost basis of 12691.23 - which breaksdown as 12674.12 (costBasis of buy @ 10/04/21 50696.47 * 0.25) + 17.11 (loss incurred with fee @ 17/06/21)

from what I gather from reading the below information from revenue.ie that 17.11 should only be offsetable when the assets bought at 19/06/21 are disposed and there is a gain - therefore the cost basis should be 12674.12 and the profit should be 1632.17

Am I interpreting this incorrectly or is it just not working correctly in koinly??

6A.3.1 Disposal of shares within four weeks of acquisition

The FIFO rules are modified in any case where shares of the same class are bought

and sold within a period of four weeks. Where shares are sold within four weeks of

acquisition the shares sold are identified with the shares acquired within that period.

Furthermore, where a loss accrues on the disposal of shares and shares of the same

class are acquired within a four week period, the loss is not available for offset

against any other gains arising and instead is only available for set off against any

gain that might arise on the subsequent disposal of the shares so acquired in the

four week period - this provision does not apply where there is a gain on the

disposal.