Hi team,

I would really like to see an option in the settings to toggle "Realize gains on crypto → stablecoin trades?”

Some tax jurisdictions make crypto swaps/trades tax exempt, but require capital gains on Crypto > Stablecoin trades/swaps.

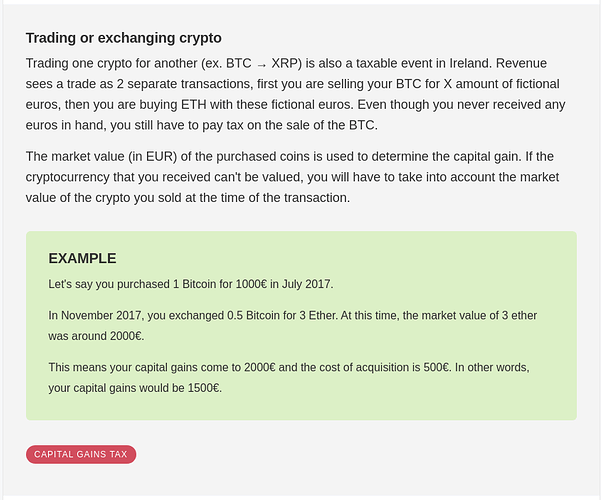

Ireland is one of these jurisdictions, and even outlined in the Koinly guide - Ireland Cryptocurrency Tax Guide 2021 | Koinly

Currently the only option that exists is “Realize gains on crypto → crypto trades”. If this includes stablecoins it makes Koinly unusable for people who need to separate the two, and a lot more manual effort.